[ad_1]

Climate Action 100+, the world’s largest investor engagement initiative on climate change, has released an interim set of Net Zero Company Benchmark assessments of its focus companies. This is the second round of Benchmark assessment to be published in 2022. The timing of this release marks a change of the analysis and reporting cycle for the Net Zero Company Benchmark assessments from March to October, to improve alignment with corporate reporting and better support investor engagement with focus companies. 159 companies on the initiative’s focus list were measured on their progress against the initiative’s three engagement goals and a set of key indicators related to business alignment with the goals of the Paris Agreement.

Progress on commitments not matched by credible plans

Though this interim update comes only six months after the previous release, the results are still revealing. While focus companies continue to make progress on net zero commitments, this is not matched by the development and implementation of credible decarbonisation strategies. While mindful of current external factors, including the short-term energy security crisis, investors consider the development of corporate decarbonisation strategies a key priority.

The Benchmark’s Alignment Assessments complement the Disclosure Framework by measuring implementation of Paris-aligned corporate actions. Whilst focus companies are incrementally improving their disclosures under the Disclosure Framework, the latest Alignment Assessments suggest their real-world activities do not yet demonstrate any meaningful shifts in business models at some companies to align with the Paris Agreement.

For example, less than one third of electric utility focus companies have a coal phaseout plan consistent with limiting global warming to below 2°C, whilst only 10% of focus companies have broad alignment between their direct climate policy engagement activities and the Paris Agreement.

However, for the first time, a small number of focus companies provided sensitivities to achieving net zero emissions by 2050 (or sooner), as assessed by CTI’s climate accounting and audit indicator. Although a minority, this is a significant step in the right direction of assessing climate change as a material risk.

The multi-layered analysis via the Disclosure Framework and Alignment Assessments highlights the value of the Benchmark’s dual approach in comparing what companies say and what they do.

Key results

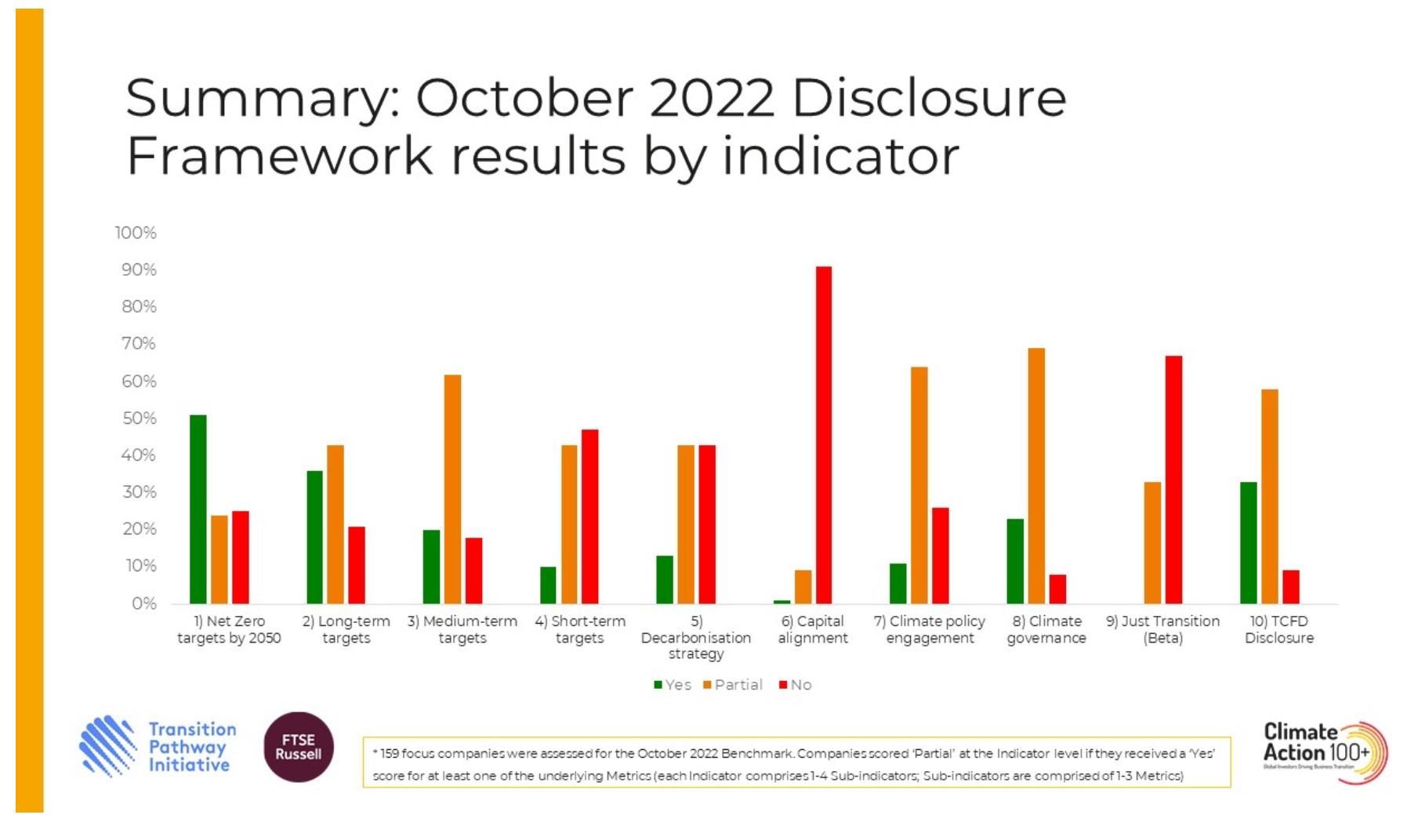

The updated assessments released today show that focus companies have continued to improve their disclosures, as shown by the Disclosure Framework, since the March 2022 release of Benchmark assessments. Driven by engagement from Climate Action 100+ investor signatories, the results show that:

- 75% of focus companies have now committed to achieve net zero emissions by 2050 or sooner across all or some of their emissions footprint (up from 69% in March 2022). In addition, over a third of focus companies have set long-term targets that align with a 1.5°C pathway (an increase of 9% from March 2022).

- 92% of focus companies have some level of board oversight of climate change (slight increase from 90% in March 2022).

- 91% of focus companies have aligned with TCFD recommendations either by supporting the TCFD principles or by employing climate-scenario planning (small increase from 89% in March 2022).

When Climate Action 100+ launched at the end of 2017, only five focus companies had set net zero commitments[4]. Investor engagement through the initiative has played a significant role in accelerating the net zero journey of focus companies, particularly around its three engagement goals of cutting greenhouse gas emissions, improving climate governance, and strengthening climate-related financial disclosures. This reinforces the value of Climate Action 100+ in facilitating targeted engagement that has resulted in a tangible impact at some of the world’s largest corporate emitters.

However, the encouraging uptake of net zero commitments is not matched by the development and implementation of credible decarbonisation strategies. As a priority, investors need to see corporates outlining the practical actions on how they will begin to meet their net zero commitments.

Specifically, the assessments reveal:

- An absence of short and medium-term emissions reductions targets aligned with limiting warming to 1.5°C. Whilst 82% of focus companies have set medium-term targets, only 20% have established ambitious medium-term targets that cover all material scopes and are aligned with a 1.5°C pathway. Only 10% of focus companies have set short-term targets (up to 2025) that are aligned with a 1.5°C scenario and cover all material emissions.

- Net zero targets are often not supported by strategies to deliver them. Although 53% of companies have a decarbonisation strategy in place to reduce their GHG emissions, only 19% of focus companies quantify key elements of their decarbonisation strategies with respect to the major sources of their emissions, including Scope 3 emissions where applicable.

- Scope 3 emissions remain absent. Only half (51%) of focus companies have comprehensive commitments for net zero by 2050 or sooner that cover all material GHG emissions, including material Scope 3 emissions.

- Alignment of capex strategies with net zero transition goals largely remain missing. Only 10% of companies have committed to fully align their capex plans with their GHG targets or the Paris Agreement. However, this is still a positive improvement since the previous Benchmark round and considering that very few focus companies score on Indicator 6 (Capital Alignment) at all.

Disclosure Framework results from the October 2022 Benchmark public summary of results – full presentation here.

The Alignment Assessments, which complement the Benchmark’s Disclosure Framework by measuring implementation of Paris-aligned corporate actions, indicate that despite continued progress on some disclosure indicators, the majority of focus company’s actions are still inadequate in aligning with the Paris Agreement.

Additionally, the Alignment Assessments indicators show:

- Less than one third (8 out of 32) of electric utility focus companies have a coal phase-out plan consistent with limiting global warming to below 2°C (not 1.5°C), according to Carbon Tracker Initiative (CTI) data. This is unchanged from the March 2022 Benchmark.

- No change for oil and gas focus companies. Almost two thirds (61%) sanctioned projects that are inconsistent with limiting global warming to below 2°C (not 1.5°C) in 2021, finds CTI.

- A step change is still needed in the build out of low carbon technologies by electric utility as well as automotive focus companies. Analysis by the Rocky Mountain Institute using the PACTA methodology shows that 94% of electric utility focus companies do not plan to build out sufficient renewable energy capacity and are on a >2.7°C global warming pathway for the next 5 years. Only 17% of automotive focus companies are planning to produce enough electric cars in the next 5 years to be aligned with the IEA Net Zero Emissions by 2050 scenario, whilst no steel, cement, or aviation focus companies’ emissions intensities are aligned with limiting global warming to either 1.5°C or below 2°C.These conclusions are unchanged from the March 2022 Benchmark.

- The climate policy engagement activities of focus companies and their industry associations remain a barrier to ambitious climate policy. According to InfluenceMap data, only 10% of focus companies have broad alignment between their direct climate policy engagement activities and the Paris Agreement (this is virtually unchanged since the March 2022 Benchmark), and only 4% align their indirect climate policy engagement via industry associations with the Paris Agreement (this is up from a mere 2% in the March 2022 Benchmark).

- The widespread failure to integrate climate risks into accounting and audit practices persists. No focus company met all criteria of the initiative’s provisional assessment on climate accounting and audit evaluated by CTI and the Climate Accounting and Audit Project (CAAP). However, three focus companies have become the first to demonstrate the impact on their financial statements using assumptions consistent with achieving net zero emissions by 2050.

[ad_2]

Source link